Unleash The Power of Your Firm's Extended Network

Verata maps your firm's collective relationships and combines them with private company intelligence—so you can source deals, hire executives, and raise capital through the power of warm introductions.

Trusted by deal teams at leading PE firms including 3 of the top 10

See Verata in Action

Watch how leading PE firms use Verata to source proprietary deals through their network.

One Platform. Every Relationship-Driven Workflow.

From deal sourcing to executive hiring to portfolio support to fundraising— Verata powers the relationship intelligence behind your firm's most important activities.

Deal Sourcing

Find proprietary opportunities and warm paths to founders before companies hit the market.

Learn moreTalent & Executive Hiring

Diligence candidates through backchannels, find board members, and verify search firm presentations.

Learn morePortfolio Value Creation

Unlock customer introductions, source add-on acquisitions, and connect portfolio companies with expert advisors.

Learn moreInvestor Relations

Map paths to institutional LPs, discover family offices in your network, and accelerate fundraising.

Learn moreYour Firm Has Thousands of Relationships. But No One Can See Them.

Partners, Principals, alumni, advisors, portfolio executives—your firm's collective network touches nearly everyone in the PE ecosystem. But when you need to reach someone specific, that relationship capital is locked in people's heads and scattered across LinkedIn profiles.

“Do we know anyone at this company?”

For deal sourcing

“Who can give us a real reference on this candidate?”

For executive hiring

“Can we intro our portco to this buyer?”

For portfolio support

“How do we get in front of this LP?”

For fundraising

These questions get asked dozens of times a week—and answered by guessing, emailing around, and hoping someone knows someone. Verata gives you the answer instantly.

The Complete Relationship Intelligence Platform

Verata combines firm-wide network mapping with private company and executive intelligence—built specifically for how PE firms work.

Relationship Path Mapping

See how your firm connects to any target—whether it's a company to acquire, an executive to hire, a customer for your portfolio, or an LP to cultivate.

- Visualize 1st, 2nd, and 3rd-degree connections to any person or company

- See the shared context that makes introductions warm—same firm, same school, same board

- Map your entire firm's collective network: partners, principals, advisors, and alumni

- Identify the optimal path to any target and who to ask for an introduction

“We found a path to a founder through an operating partner we'd never have thought to ask. One warm introduction and we had a meeting. That's proprietary sourcing.”

Principal

Mid-Market PE Firm

Private Company & Executive Intelligence

Research any company or executive in seconds with comprehensive profiles built for PE due diligence.

- Revenue estimates using comparable company methodology—transparent and auditable

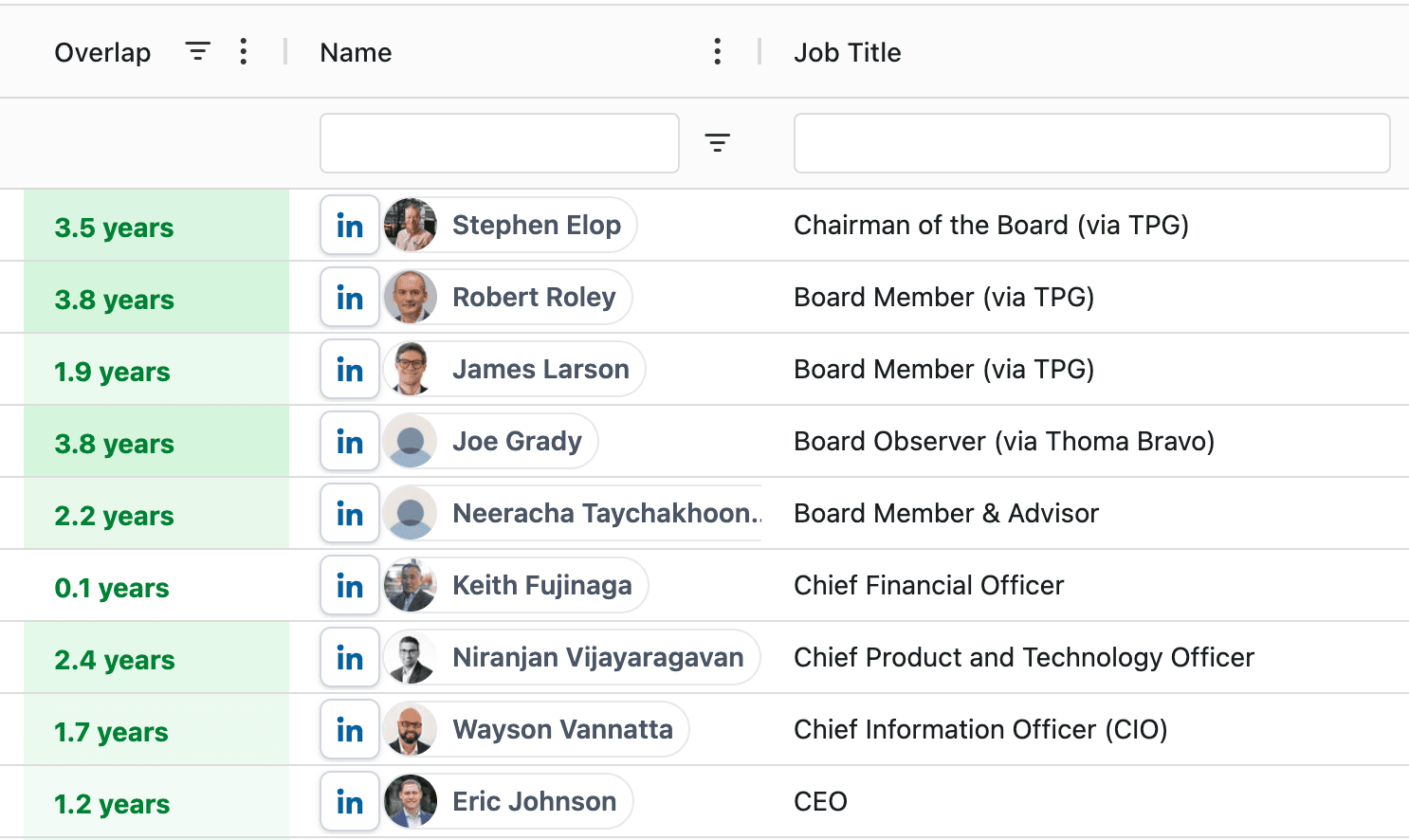

- Complete work histories with verified dates, titles, and overlapping colleagues

- Transaction history: which deals, which sponsors, what outcomes

- Leadership profiles with board seats, advisory roles, and career trajectories

“I walked into a meeting knowing their revenue estimate, their headcount trajectory, and that their CFO used to work with our Operating Partner. The CEO asked how I knew so much.”

Director

Healthcare PE Firm

Backchannel & Reference Discovery

Find the people who can give you the real story—on executives, companies, and opportunities.

- Identify colleagues who overlapped with any executive during their tenure

- See exact co-tenure periods to find the most relevant references

- Map paths to backchannels through your firm's network

- Verify search firm candidates with independent sources

“We almost made a very expensive hiring mistake. Verata showed us a backchannel we would never have found otherwise. That one insight saved us 18 months and a failed placement.”

Talent Partner

$3B AUM Firm

Powerful Search & Filtering

Find exactly what you're looking for—companies, executives, board candidates, or LP targets—with filters built for PE.

- Company search: geography, revenue, sector, ownership status, PE backing

- Executive search: function, industry, PE experience, transaction history

- Portfolio mapping: identify talent at competitor portfolios nearing exit

- Save searches, set alerts, and export to Excel for team review

How PE Firms Use Verata

The same relationship intelligence powers every relationship-driven workflow at your firm.

Proprietary Deal Origination

Find companies that match your thesis and identify warm paths to reach founders before competitors.

Executive Due Diligence

Find backchannels to diligence management teams and verify search firm candidates independently.

Board & Advisor Placement

Find qualified board candidates and expert advisors who are accessible through your network.

Customer Introductions

Help portfolio companies land enterprise customers through warm introductions from your network.

Add-On Acquisition Sourcing

Find proprietary add-on opportunities through relationships and off-market conversations.

LP Relationship Mapping

See warm paths to institutional allocators and discover family offices in your extended network.

The ROI of Relationship Intelligence

One proprietary deal, one avoided bad hire, one customer intro, one LP meeting— each pays for Verata many times over.

+40%

Proprietary deal flow

3x

More backchannels found

$50M+

Portfolio revenue facilitated

2-3x

LP meeting conversion

“We closed a $200M deal that started with a Verata search. The company wasn't on any banker's radar. We found them, had a path through an alumni connection, and got there first. That one deal paid for Verata for decades.”

Principal, Industrials-Focused PE Firm

What PE Teams Are Saying

“Verata changed how we source. We went from hoping our network would produce deals to systematically activating it. Our proprietary deal flow is up 40%.”

Managing Partner

$2B AUM Firm

“We almost made a very expensive hiring mistake. Verata showed us a backchannel we would never have found otherwise. That one insight saved us 18 months.”

Talent Partner

$3B AUM Firm

“The customer introduction capability alone justifies the investment. We've helped portfolio companies close over $50M in new business through network-sourced introductions.”

Operating Partner

Mid-Market Buyout

See Your Network. Activate Your Relationships.

Join leading PE firms including 3 of the top 10 using Verata to source deals, hire executives, support portfolio companies, and raise capital through relationships.

14-day free trial • No credit card required • See your firm's actual network mapped

Frequently Asked Questions

We identify high-quality professional relationships from verified sources using proprietary methods. Unlike LinkedIn—where people accept requests from anyone—every Verata connection represents a real professional relationship. You won't embarrass yourself asking the wrong person for an introduction.

Verata supports the full range of relationship-driven activities at PE firms: deal sourcing (finding targets and warm paths), talent (executive diligence and board placement), portfolio value creation (customer intros and add-on sourcing), and investor relations (LP mapping and fundraising). The same relationship intelligence powers all of these workflows.

We estimate revenue using comparable company analysis—the same methodology you'd use in a model. We show you the comps we're using and the methodology so you can assess confidence. For most private companies, it's the best estimate available.

For any executive, we identify people who overlapped with them during their tenure—former colleagues, supervisors, board members, and direct reports. We show you exact co-tenure periods and map paths from your firm to these potential references. This gives you independent verification beyond the references candidates provide.

Verata integrates with DealCloud, Salesforce, and Affinity on Professional and Enterprise tiers. Your pipeline stays synced without double entry. Most firms use Verata as the starting point for sourcing, diligence, and relationship research.